Winter fragrances in Europe are all about warmth, comfort, and sophistication during the colder months. With a focus on rich, long-lasting scents, the market has seen a shift toward luxurious formulations that cater to self-expression and seasonal needs. Here’s a quick overview of key trends and insights:

- Popular Notes: Warm, woody, spicy, and amber tones dominate. Gourmand fragrances with marshmallow, cocoa butter, and burnt sugar are paired with woods and spices for depth. Dark fruits like cherry and plum are also trending.

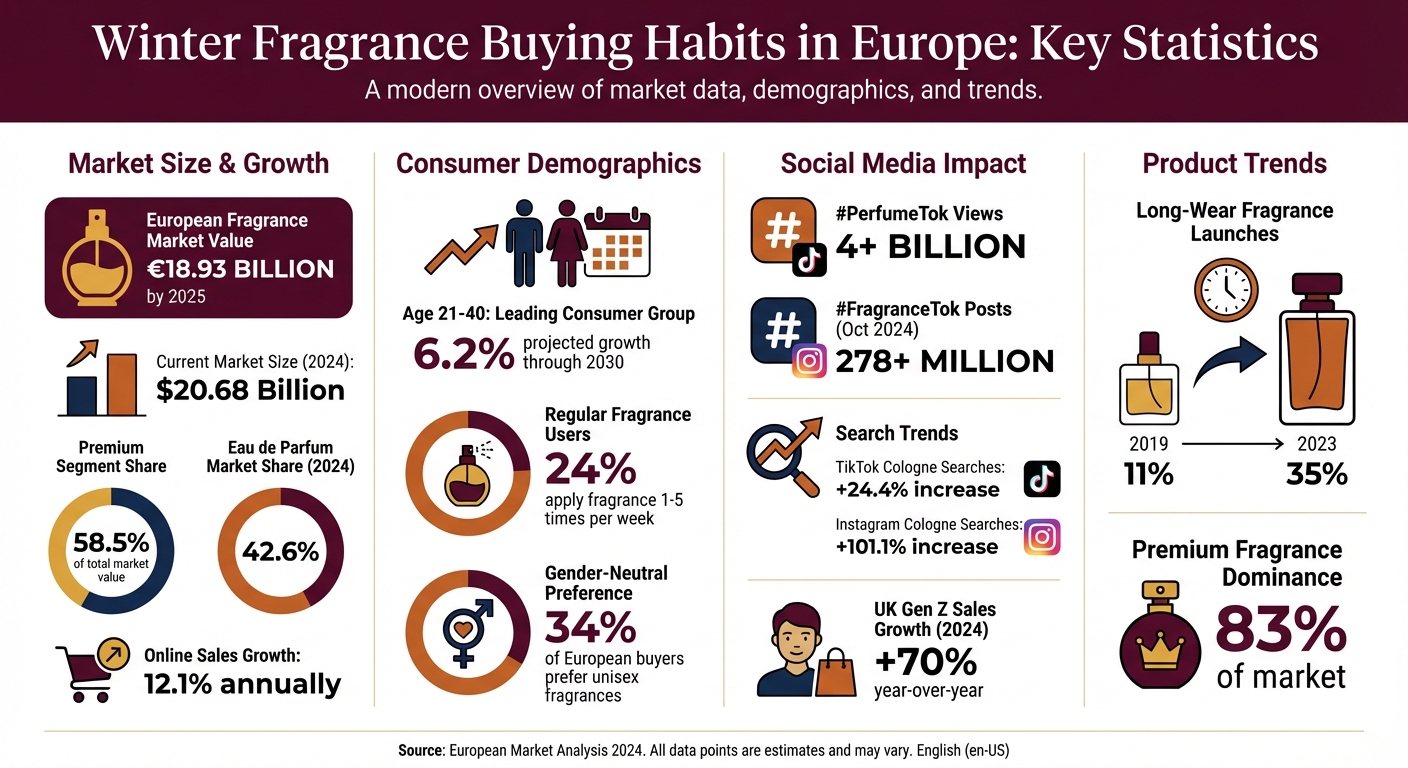

- Market Growth: The European fragrance market is projected to reach €18.93 billion by 2025, with premium fragrances leading at 83% of the market.

- Consumer Behavior: Younger buyers (21–40) prefer versatile, mood-matching scents, while older consumers prioritize timeless, high-quality options. Gender-neutral fragrances are gaining popularity, especially among Gen Z.

- Social Media Influence: Platforms like TikTok and Instagram drive fragrance trends, with hashtags like #PerfumeTok amassing billions of views. Online searches and sales are heavily influenced by social recommendations.

- Seasonal Demand: Winter holidays and gifting seasons boost sales, with consumers favoring bold, statement-making fragrances for festive events. Fragrance layering and daily wear habits further shape buying patterns.

Scento, a fragrance retailer, supports these trends by offering smaller decants (8ml) of premium scents, allowing customers to try high-end fragrances without committing to full-size bottles. This approach caters to the growing demand for curated fragrance wardrobes, reduced waste, and affordability in the luxury market.

Winter Fragrance Market Statistics and Consumer Trends in Europe 2024-2025

Winter Fragrance Trends in Europe

Popular Notes and Scent Families

When it comes to winter fragrances, European consumers gravitate toward woody, spicy, and amber notes that bring warmth to the season. At the same time, traditional scent categories are evolving into richer and more layered profiles.

Gourmand fragrances, for instance, have taken on a more refined edge. Ingredients like marshmallow, pistachio, cocoa butter, and burnt sugar are now being paired with resins, woods, and spices to create a deeper and more luxurious appeal. Octavia Morgan, Founder of Octavia Morgan Los Angeles, explains:

"Gourmands are moving beyond playful sweetness into richer, more sensual territory... Edible notes like roasted chestnut, smoked honey, cherry, plum or dark cacao are paired with resins, woods, and spices".

Dark fruits are also making waves this winter. Cherry, raspberry, and plum are leading the charge, while strawberry is emerging as a rising star in high-end fragrance compositions. Another standout is pink pepper, which has become a must-have ingredient for adding a bright, sparkling twist to heavier winter scents.

An unexpected newcomer to the winter fragrance scene is the "polar plunge" aesthetic. Here, brands incorporate aldehydes, mint, eucalyptus, and crisp florals to evoke the icy freshness of snow. This trend offers a refreshing contrast to the season’s traditional warm and cozy scents. LaRen Johnson, Fragrance Expert at ScentMatch, captures this balance perfectly:

"Winter fragrances are leaning warmer and more inviting, but still with a modern, fresh vibe. They wrap you up like a soft blanket but still carry a cool, sophisticated edge".

In terms of fragrance concentration, Eau de Parfum dominates the European winter market, accounting for 42.6% of sales in 2024. Its higher oil content (ranging from 10-20% or more) ensures that scents last longer, even on heavy winter clothing or in chilly air. Between 2019 and 2023, fragrance launches boasting long-wear claims surged from 11% to 35%, reflecting the growing demand for longevity in colder months.

These evolving scent preferences are not just confined to the bottle - they’re also shaping social media trends, which play a growing role in influencing consumer choices.

Social Media’s Impact on Fragrance Trends

Social media has become a key driver in how consumers discover and engage with fragrances. Platforms like TikTok and Instagram are reshaping the industry, with hashtags such as #PerfumeTok amassing over 4 billion views and #FragranceTok generating more than 278 million posts as of October 2024.

The influence of social media is clear in search behavior. Over the past year, searches for "cologne" climbed by 24.4% on TikTok and an impressive 101.1% on Instagram. In the UK, Gen Z fragrance sales saw a 70% year-on-year increase in 2024, largely fueled by trends and recommendations circulating online.

Social media doesn’t just create buzz - it also shapes buying habits. Arnaud Guggenbuhl, Head of Global Marketing Insight and Image at Givaudan, highlights this shift:

"Long lasting fragrances with strong sillage remain highly sought after, and on TikTok, the current craze is to prolong the longevity and diffusion of one’s scent trail".

This has led to the rise of "fragrance wardrobes", where younger consumers curate multiple scents for different occasions instead of sticking to a single signature fragrance. This trend is particularly popular in Northern Europe, where people choose specific winter scents to match activities or moods.

The market’s shift toward premium, long-lasting formulations is evident in recent bestsellers. In January 2025, the top three men’s fragrance launches across Europe were YSL MYSLF Le Parfum, Jean Paul Gaultier Scandal Pour Homme Absolu, and Boss The Scent Elixir. All three are intense, high-concentration versions of existing fragrances, reflecting the demand for bold, enduring winter scents.

Consumer Demographics and Buying Behavior

Age — Based Preferences

In Europe’s winter fragrance market, the 21–40 age group is leading the charge, with a projected growth rate of 6.2% through 2030. This age group, often enjoying financial stability, tends to invest in fragrances that match their varying moods and occasions.

For younger consumers, fragrances have become a tool for self-expression. According to Euromonitor International:

"Demand for unique or customised fragrances is increasing, especially from young consumers, as fragrance is becoming a way to express individuality or be recognised in the crowd".

This generation often seeks nostalgic gourmand scents like chocolate, caramel, and vanilla, along with trendier profiles such as "Caramelized Smoke".

Meanwhile, buyers aged 41 and older lean toward warm, traditional bases like sandalwood, orris root, and powdery amber. They tend to prioritize timeless, high-quality scents over fleeting trends, often sticking with established luxury brands.

Interestingly, these generational preferences are blending with changing gender norms, influencing how people select their fragrances.

Gender Differences in Scent Selection

When it comes to winter fragrances, men and women often have distinct priorities. Men typically seek fragrances that exude luxury, offer long-lasting wear, and enhance their mood. Women, on the other hand, are drawn to unique note combinations, followed by a premium feel and longevity.

However, traditional gender lines are becoming less defined. Women are showing increasing interest in woody and smoky scents once marketed to men, while men are exploring amber and gourmand profiles that were traditionally considered feminine. Among younger consumers, this shift is particularly pronounced - 34% of European buyers now actively prefer gender-neutral fragrances.

Winter Purchasing Patterns

Holiday and Gift Purchases

As the holiday season approaches, fragrance sales in Europe experience a significant surge, driven by both new product launches and increased consumer spending during Christmas preparations. Winter weddings and festive gatherings further amplify the demand for bold, statement fragrances. Taylor Hoff from NOYZ highlights this seasonal shift:

"There is a real craving for warmth during these months. You also see deeper, more intense scents trend upward as holiday parties and special occasions take over the season".

But it’s not just about celebrations. Fragrances become a source of comfort during the colder, darker months. For many, they offer a sense of emotional support, as Carol Han Pyle, founder of NETTE, explains:

"In winter, fragrance is almost emotional support. People want scents that feel like a hug".

This growing focus on self-care has led more consumers to purchase fragrances as personal indulgences rather than gifts alone.

Economic concerns have also influenced buying behavior. Shoppers are opting for fewer but higher-quality fragrances, often purchasing them immediately to secure the best prices. Magda Starula from Euromonitor International observes:

"The essence is that we buy less but spend more. Consumers are obviously uncertain about tomorrow and they are trying to think of the best purchasing strategies".

While seasonal gifting remains a major driver, everyday habits like fragrance layering are also shaping how people use and choose scents during winter.

Fragrance Layering and Daily Wear

Fragrance layering has become a key winter ritual across Europe. By combining body oils, mists, and perfumes, consumers are creating richer, more personalized scent profiles. This practice not only enhances longevity but also helps fragrances adhere better to dry, winter-affected skin. Hydrating formats such as fragrance oils, balms, and solids are increasingly popular, as they "nourish the skin while helping your scent last longer".

Daily fragrance use also plays a prominent role in winter routines. A notable 24% of European consumers apply fragrance 1–5 times per week, one of the highest usage rates globally. This routine often involves balancing scents for different occasions - minimal sprays for formal settings and 3–5 sprays for casual, everyday wear. These habits highlight the importance of fragrance as both a personal expression and a seasonal comfort.

Your Personal Fragrance Expert Awaits

Join an exclusive community of fragrance connoisseurs. Each month, receive expertly curated selections from over 900+ brands, delivered in elegant 8ml crystal vials. Your personal fragrance journey, meticulously crafted.

Try Your First MonthHow Scento Supports Winter Fragrance Exploration

Winter Scent Discovery with Scento

Scento taps into evolving winter buying habits by offering practical ways to explore premium fragrances. Winter scents often feature intricate notes like vanilla, amber, oud, and smoky leather, with full-size bottles sometimes exceeding $300. To make these luxurious options more accessible, Scento provides 8ml decants, giving shoppers the chance to test high-end fragrances without committing to the hefty price tag. Each 8ml vial delivers approximately 120 sprays, offering weeks of wear to fully experience how the scent develops in colder weather.

As preferences shift toward flexible, multi-scent collections, Scento caters to this trend with its "fragrance wardrobe" approach. This allows users to explore multiple scents that match different moods and occasions. Their one-time decants, available in 0.75ml, 2ml, and 8ml sizes, along with an optional 8ml subscription, make it easy to build a collection without cluttering shelves with half-used bottles. Whether it’s a deep gourmand blend with caramel and musk or a boozy scent featuring rum and cognac, Scento offers a range of choices for winter’s unique demands.

The subscription model adds another layer of flexibility. As the seasons shift, subscribers can trade lighter summer scents for richer winter profiles, like aged woods or decadent gourmands recommended for the 2025/2026 season. This adaptability is particularly appealing in a market where the premium segment accounted for 58.5% of European fragrance sales in 2024, with online sales growing by 12.1% annually. By simplifying the discovery process and reducing unnecessary spending, Scento helps fragrance lovers embrace seasonal changes with ease.

Reducing Waste and Cost

Scento’s model addresses modern buying concerns by cutting down on both financial risk and product waste. In a $16.03 billion fragrance market, many consumers end up with unused full-size bottles. Scento combats this issue by offering smaller, more practical decant sizes, reducing the likelihood of waste while also minimizing packaging disposal - an important consideration in the $57 billion European beauty market.

This approach resonates in an era of economic uncertainty, where buyers are keen to make thoughtful purchases. Scento provides an affordable way to experience premium winter scents, which typically cost between $151 and over $300 for full-size bottles. By offering smaller, lower-risk options, Scento makes it easier for consumers to indulge in luxury without overspending or committing prematurely.

Additionally, the focus on smaller, eco-conscious packaging aligns with the growing demand for sustainable practices among European fragrance enthusiasts. With Scento, consumers can enjoy high-end fragrances while making choices that are kinder to both their wallets and the planet.

The Fragrances I Can’t Stop Wearing This Winter | Cozy, Comforting & Sweet

Conclusion

The European winter fragrance market is evolving at a brisk pace. By 2024, the industry reached an impressive $20.68 billion, with the premium segment accounting for 58.5% of its value. This shift reflects a growing preference for fragrance wardrobes - where consumers rotate scents based on mood and occasion rather than sticking to a single signature scent. Winter fragrances lean into cozy, opulent notes like vanilla, amber, oud, and smoked leather, perfectly aligning with the season’s demand for enveloping aromas.

Demographic changes are also reshaping the market. Gen Z, for instance, spurred a 70% year-over-year growth in UK fragrance sales in 2024. Meanwhile, older consumers are drawn to longer-lasting options, boosting eau de parfum to a 42.6% market share. Additionally, the rise of unisex fragrances reflects the ongoing breakdown of traditional gender norms, appealing to a broad spectrum of age groups.

Economic uncertainty has further influenced consumer behavior, fostering a "buy less, spend more" mindset. This has led to a demand for flexible purchasing options that balance luxury with practicality.

To meet these shifting preferences, Scento offers an appealing solution. Their 8ml decants, providing around 120 sprays, allow consumers to test scent longevity without committing to full-sized bottles priced at $300 or more. This format resonates with the 24% of European consumers who use fragrance regularly, enabling them to explore a variety of scents while minimizing waste.

As discussed, the future of fragrance buying in Europe is being shaped by a desire for sustainable, personalized experiences. Services that prioritize discovery and reduce excess waste are winning over shoppers who value individuality and affordable luxury, especially in uncertain economic times.

FAQs

What fragrance notes are most popular in Europe during winter?

In Europe, winter fragrances tend to highlight warm, rich notes that bring a sense of coziness and refined charm. Common favorites include oud, amber, leather, woody accords, musk, and vanilla. To enhance their allure, these are often paired with chypre and resinous elements, creating layers of depth and sophistication.

These opulent combinations are ideal for the colder months, wrapping wearers in an aura of warmth and understated elegance that perfectly suits the winter season.

How does social media impact how people buy winter fragrances?

Social media has become a key player in how Europeans find and select their winter fragrances. Platforms like Instagram, TikTok, and Pinterest captivate users with visually rich content, spotlighting seasonal favorites such as gourmands, dark florals, and soft woods. Influencers and brands leverage these platforms to showcase trending scents, turning eye-catching posts into immediate shopping inspiration.

This trend ties seamlessly with the rise of online shopping across Europe, where convenience and discovery are top priorities. Features like promotions, quick checkout options, and discovery tools - such as decants or fragrance subscriptions - make it easier than ever to explore new scents. By blending trending recommendations with social proof through likes, comments, and shares, social media simplifies the decision-making process and nudges shoppers toward experimenting with fresh fragrance choices.

Why are smaller fragrance decants becoming more popular in Europe?

Smaller fragrance decants are gaining traction among perfume enthusiasts, offering an affordable way to explore a variety of scents without splurging on full-sized bottles. These compact options allow shoppers to sample multiple fragrances, helping them find favorites without the risk of wasting money - or product - on something they might not love.

These trial sizes are also ideal for those who enjoy switching up their scent to suit different occasions, seasons, or even their mood. By choosing smaller bottles, shoppers can indulge in high-quality perfumes and experiment freely, all while keeping their spending in check.