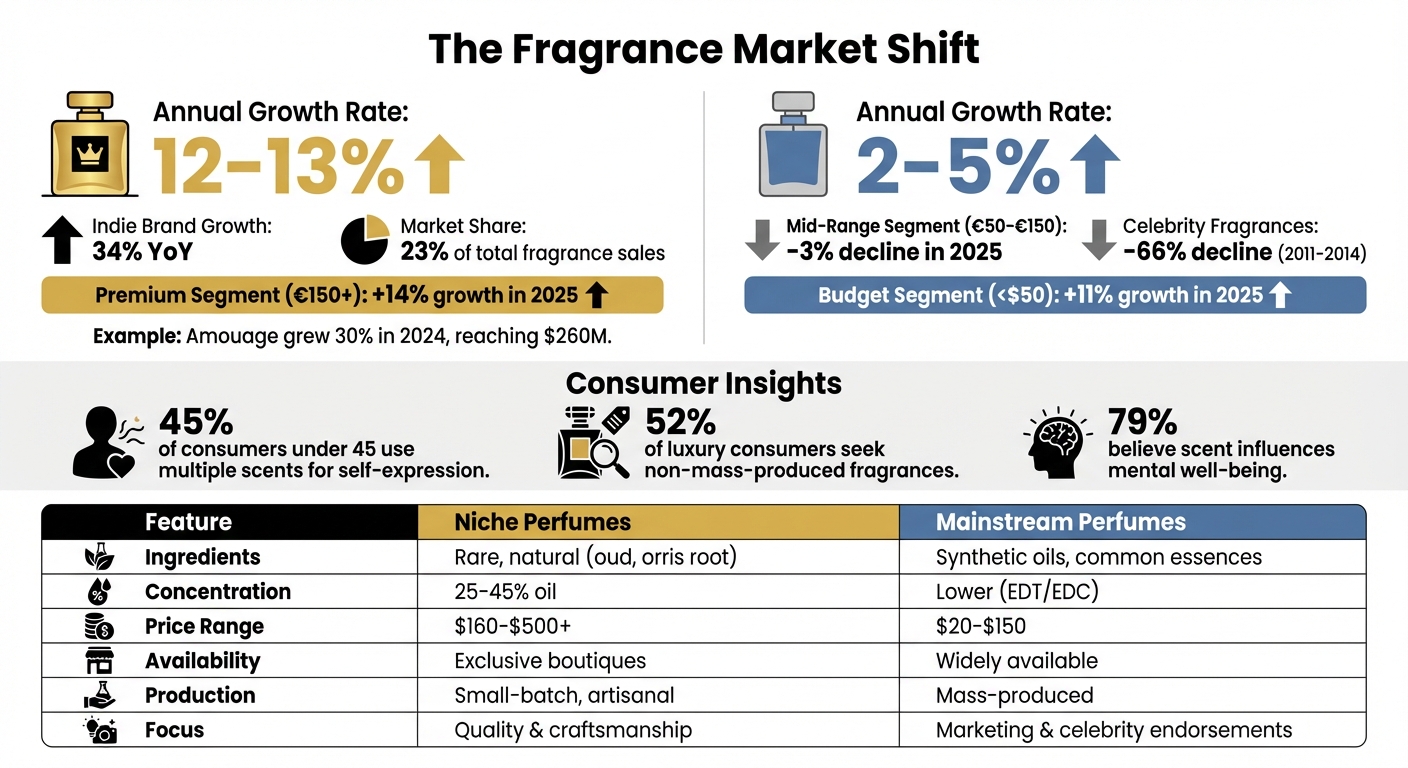

Niche perfumes are outperforming mainstream fragrances, with sales growth of 12%-13% annually compared to 2%-5% for traditional brands. In 2025, perfumes priced over €150 grew by 14%, while mid-range options (€50–€150) declined by 3%. What’s driving this shift?

Niche brands prioritize the scent itself, using rare ingredients, high concentrations (25%-45%), and small-batch production. They skip flashy marketing, focusing instead on quality and exclusivity. Consumers, especially younger ones, now value fragrances as a form of self-expression, with 45% of those under 45 using multiple scents to reflect their identity.

Luxury buyers also seek limited-edition offerings, personalization, and eco-conscious practices like refillable bottles and lab-grown ingredients. Meanwhile, mainstream brands struggle to compete, with celebrity-endorsed options falling out of favor.

Key Takeaways:

- Growth: Indie brands now make up 23% of fragrance sales, growing 34% annually.

- Consumer Trends: Younger shoppers prefer unique scents and storytelling over mass-market appeal.

- Luxury Appeal: High-end buyers invest in artisanal craftsmanship and bespoke services.

- Sustainability: Eco-friendly practices are becoming standard in the niche market.

Niche perfumes are reshaping the industry by focusing on individuality, quality, and craftsmanship - values that resonate with modern fragrance enthusiasts.

Niche vs Mainstream Perfumes: Market Growth and Key Differences

1. Niche Perfumes

Market Growth

The niche perfume market has seen impressive growth in recent years. Indie brands now account for 23% of total fragrance sales, with a year-over-year growth of 34%. In 2024, US perfume sales climbed 12%, reaching $9.5 billion, largely fueled by the niche segment.

Take Amouage, for example - a standout in this thriving category. By June 2025, the Omani fragrance house reported a 30% growth for 2024, surpassing $260 million in annual retail sales. This marks a dramatic increase, more than doubling its revenue in just three years. Such success has caught the attention of luxury giants. Notably, Kering‘s $3.8 billion acquisition of Creed underscores the long-term confidence in the niche fragrance market.

Consumer Preferences

Consumer tastes are shifting alongside this growth. Nearly 45% of individuals under 45 now embrace the idea of using multiple scents to express their personal identity. This change reflects a broader evolution in values, where storytelling and the emotional connection to a product take center stage.

Linda Levy, President of the Fragrance Foundation, highlights this trend:

"The indies have been growing ‘exponentially.’ They’re often on a level playing field with big brands in direct-to-consumer storytelling and engagement".

Social media, especially TikTok, has played a pivotal role in this movement, enabling lesser-known and unconventional scents to gain massive popularity.

Exclusivity and Customization

The appeal of niche fragrances lies in their limited availability and artisanal craftsmanship. A striking example comes from December 2024, when Krigler opened a boutique at The Peninsula Paris. On its first day, a single customer spent €100,000 ($114,000) on exclusive, limited-edition flacons.

This dedication to quality and creativity is echoed by Marc — Antoine Barrois, founder of his namesake perfume house:

"We have no limits on Quentin’s [Bisch] time or on the ingredients we put in. The exact costs remain secondary to creative freedom".

Such an approach resonates with the 52% of luxury consumers who actively seek fragrances that aren’t mass-produced. To cater to this demand, brands are introducing AI-powered scent-matching tools and bespoke creation services, allowing customers to craft fragrances that align with their unique lifestyles. These innovations not only elevate the customer experience but also pave the way for advancements in production and sustainability.

Sustainability and Innovation

Exclusivity in niche perfumes now goes hand-in-hand with sustainable practices, reflecting the growing importance of environmental consciousness among consumers. Brands are adopting measures like refillable packaging, upcycled ingredients, and AI-driven scent personalization to meet these expectations.

In Germany, 79% of fragrance users believe scent can positively influence mental well-being. This has spurred interest in "neuro-fragrances" designed to enhance mood or relieve stress. On the production side, lab-grown molecules and responsibly sourced materials are becoming standard, as sustainability shifts from being a marketing angle to a core purchasing factor.

2. Mainstream Perfumes

Market Growth

Mainstream perfumes are facing challenges as consumer interests continue to shift. The once-thriving mid-range price segment - sitting between affordable and ultra-premium options - has been shrinking, with celebrity-endorsed scents taking the hardest hit. Between 2011 and 2014, sales of celebrity fragrances in U.S. department stores plummeted by 66%. Don Loftus, President of Parlux Ltd, expressed the industry’s struggle:

"Retail right now is really tough and it’s because it’s all gotten so mediocre. It’s all about the quality... it’s not like putting out soda pop".

These changes are forcing mainstream brands to rethink their strategies to stay relevant.

Consumer Preferences

Unlike niche perfumes, which emphasize ingredient quality and exclusivity, mainstream brands are now experimenting with upscale lines to regain consumer trust. High-profile fashion houses like Bottega Veneta, Rabanne, and Balmain have launched premium collections priced between $300 and $467. Fragrance consultant Robert Sorce highlights this shift:

"A lot of prestige brands are thinking, ‘How do I really upscale to compete with those niche brands?’".

However, this approach comes with challenges. Niche brands have built their reputation on practices like extended maturation periods and higher concentrations of quality ingredients, while mainstream brands have traditionally leaned on frequent product launches and celebrity endorsements. John Demsey, Executive Group President at Estée Lauder Companies, acknowledged this evolution:

"Niche is the new normal. Many niche ideas have become very commercial".

As the market evolves, consumers are placing more value on the actual quality of the fragrance - the "juice" itself - rather than the celebrity name attached to it.

2025 niche fragrance trends and origin stories

Your Personal Fragrance Expert Awaits

Join an exclusive community of fragrance connoisseurs. Each month, receive expertly curated selections from over 900+ brands, delivered in elegant 8ml crystal vials. Your personal fragrance journey, meticulously crafted.

Try Your First MonthPros and Cons

Building on earlier insights into market trends and consumer preferences, here’s a closer look at the key differences between niche and mainstream perfumes. The choice between these two categories often depends on what you value more: exclusivity and craftsmanship or convenience and affordability.

Niche perfumes stand out for their use of premium ingredients and higher concentrations of fragrance oils (ranging from 25% to 45%). This results in longer-lasting, more intricate scents. As Renaud Salmon, Chief Creative Officer of Amouage, explains:

"From my experience creating for other luxury brands, this number [ingredient concentration] is at least ten times higher than what is typically allowed."

But this level of quality comes at a cost. Niche fragrances are priced significantly higher than their mainstream counterparts, often costing 150% to 250% more, with entry-level bottles starting at approximately $160 per ounce.

Mainstream perfumes, on the other hand, are designed for accessibility. They are widely available in department stores, airports, and online, and their affordability makes them appealing to a broad audience. Fragrances priced under $50 saw an 11% sales increase in early 2025, showing strong demand for budget-friendly options. However, these perfumes often rely on synthetic oils and lower concentrations, which can lead to simpler scent profiles and shorter wear durations.

| Feature | Niche Perfumes | Mainstream Perfumes |

|---|---|---|

| Ingredients | Rare, natural elements like oud or orris root | Synthetic oils and common essences |

| Concentration | High (25%–45% oil) | Lower (typically EDT or EDC) |

| Price Range | $160–$500+ per bottle | $20–$150, with body mists under $50 |

| Availability | Limited to exclusive boutiques and luxury retailers | Widely available across retail outlets |

| Scent Profile | Complex and distinctive | Broad appeal, often trend-driven |

| Production | Small-batch, artisanal, often hand-filled | Mass-produced with standardized formulas |

Each category has its strengths and trade-offs. Whether you lean toward the artistry of niche perfumes or the practicality of mainstream options depends on your personal preferences and priorities.

Conclusion

The rise of niche fragrances marks a noticeable shift in how consumers approach perfume. For many, especially Millennials and Gen Z, fragrance has evolved from being just a pleasant addition to their routine into a form of self-expression and identity. In fact, nearly half of younger shoppers now view scent as a personal statement. Instead of sticking to a single signature fragrance, many are curating "fragrance wardrobes" tailored to different moods and occasions.

What sets niche perfume brands apart is their dedication to craftsmanship. Unlike mainstream brands that often emphasize celebrity endorsements and large-scale marketing campaigns, niche houses focus on the artistry of the fragrance itself. They prioritize rare ingredients, higher concentrations, and small-batch production to deliver a truly unique experience.

The numbers reflect this growing interest. Indie fragrance brands have seen a 34% year-over-year growth, now accounting for 23% of total sales. Meanwhile, ultra-luxury fragrances priced above $150 grew by 14% in the first quarter of 2025, while the traditional premium segment ($50–$150) declined by 3%. This data points to a market increasingly divided between budget-friendly options and those willing to pay a premium for exceptional quality.

For those intrigued by niche perfumes, the cost of entry can be daunting - full-sized bottles often start at around $160. This is where discovery formats, like Scento’s curated decants, come into play. Offering sizes as small as 0.75ml, along with 2ml and 8ml options, they provide an accessible way to explore niche scents before committing to a full bottle.

The continued growth of niche perfumes lies in their ability to offer authenticity and personalization. Today’s consumers are drawn to fragrances with compelling stories, transparent sourcing, and distinctive compositions that help them stand out. With online fragrance sales expected to grow over 10% annually and the luxury segment projected to expand at a rate of 3.85% through 2029, the niche market is poised for sustained success. This evolution underscores a broader redefinition of luxury fragrance - one that celebrates artistry, individuality, and the allure of quality craftsmanship.

FAQs

Why are niche perfumes becoming so popular?

Niche perfumes are becoming increasingly sought after because they deliver distinctive and personal scent experiences that stand out from the crowd of mass-market fragrances. People are gravitating toward fragrances that express their individuality rather than simply following popular trends. These artisanal scents often incorporate rare ingredients, bold compositions, and limited-edition offerings, giving them an air of exclusivity and a sense of being thoughtfully crafted.

What sets niche perfumes apart is their focus on artistry and quality over flashy marketing. Instead of being drawn in by brand names or heavy advertising, many consumers are paying closer attention to how a fragrance interacts with their skin, prioritizing the scent itself. This desire for a more personalized and unique experience is fueling the rising demand for niche fragrances, which have quickly become one of the most dynamic segments in the global perfume industry.

How are niche perfumes embracing sustainability?

Niche perfume brands are reshaping the fragrance industry with a focus on quality and eco-conscious values. These brands often rely on natural, ethically sourced ingredients like Bulgarian rose, Madagascan vanilla, and Indonesian patchouli. By steering clear of synthetic chemicals that can harm the environment, they create fragrances that are not only luxurious but also environmentally considerate. Plus, their use of higher concentrations of premium materials means the scents last longer, promoting mindful consumption and reducing waste.

Many of these brands embrace low-impact production techniques, such as crafting fragrances in small batches and creatively upcycling by-products like orange peels or coffee grounds into distinct scent notes. This approach not only reduces waste but also opens the door to inventive fragrance profiles. On top of that, they often prioritize sustainable packaging, opting for recycled materials, refillable bottles, and minimalist designs to avoid unnecessary waste.

Blending responsibly sourced ingredients, innovative production methods, and eco-friendly packaging, niche perfumes deliver a sophisticated experience that aligns with a commitment to protecting the planet.

Why are younger consumers drawn to niche fragrances?

Younger consumers, particularly Gen Z, are gravitating toward niche fragrances as a way to showcase their individuality and share their personal stories. Platforms like TikTok have transformed fragrance discovery into a social phenomenon, where users enthusiastically share their favorite scents and spark conversations around limited-edition or artisanal creations. This growing "fragrance culture" has turned the hunt for rare and distinctive perfumes into an enjoyable and trendy pastime.

Niche brands are meeting this demand head-on by offering exclusive collections that feel personal and story-driven. For those hesitant to invest in pricey full-sized bottles, options like Scento’s curated decants - available in 0.75 ml, 2 ml, and 8 ml sizes - provide an accessible way to explore a wide range of fragrances. Their optional 8 ml subscription adds even more flexibility, catering to the younger generation’s love of discovery, novelty, and a mindful approach to consumption.